A routing number, also known as an ABA (American Bankers Association) routing number, is a nine-digit code used in the United States to identify financial institutions.

This unique identifier facilitates the accurate and efficient processing of financial transactions between banks.

And almost each state for BOA, has its own.

Why is the Routing Number Important?

- Direct Deposits: Employers use your bank’s routing number to deposit your paycheck directly into your account.

- Automatic Bill Payments: Companies require it to set up automatic withdrawals for bills.

- Wire Transfers: Necessary for transferring funds domestically or internationally.

- Ordering Checks: Ensures the checks are linked to the correct bank and account.

Bank of America’s Routing Numbers

Bank of America (BofA) is one of the largest banking institutions in the United States, and it operates with multiple routing numbers across different states.

This is primarily due to mergers, acquisitions, and the bank’s expansive footprint.

How to Find Your Routing Number

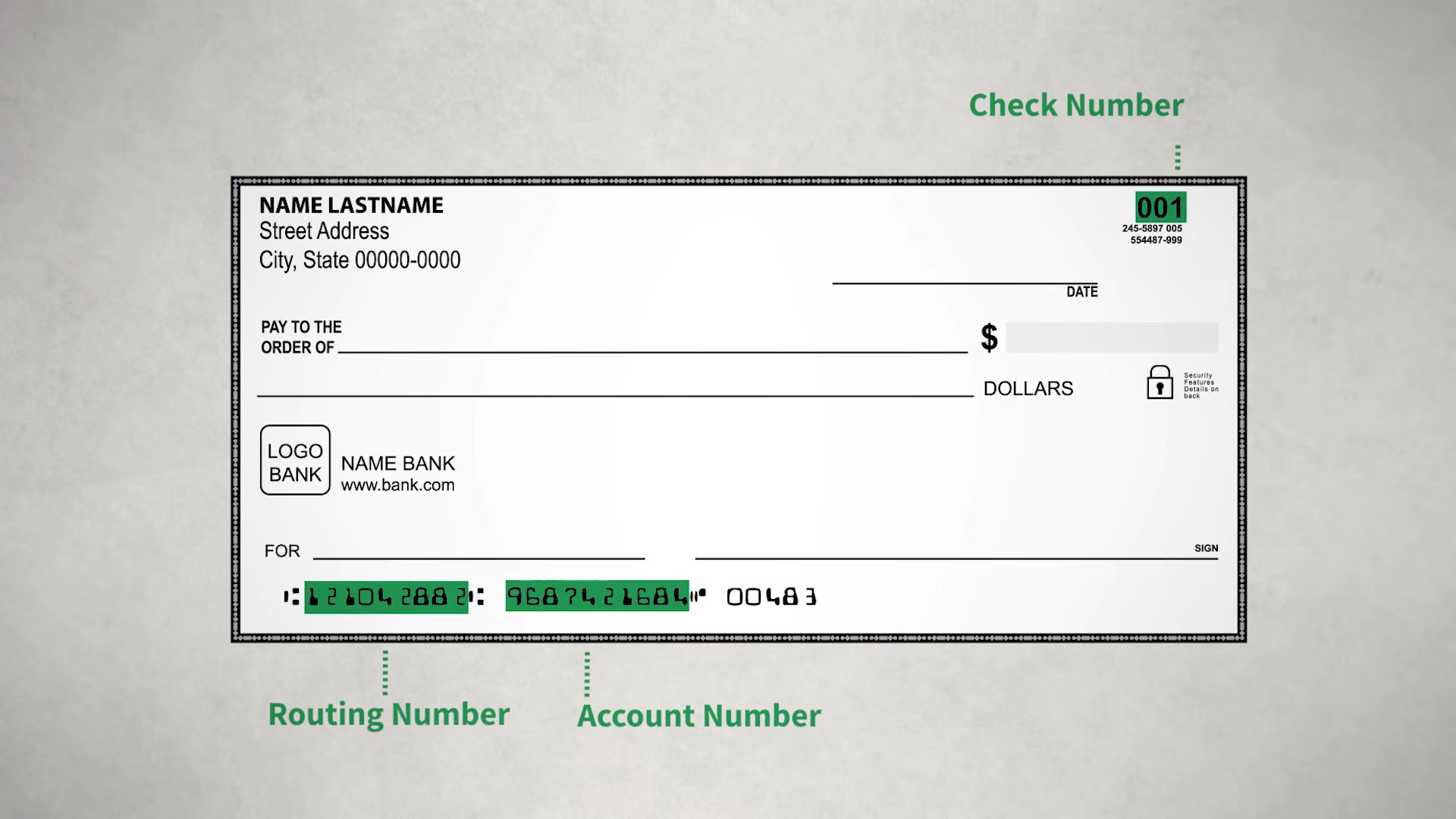

- On a Check: The routing number is typically the first nine-digit number located at the bottom-left corner of your check.

- Online Banking: Log into your Bank of America online account and navigate to the “Information & Services” tab to find your routing number.

- Bank Statements: Some statements may include the routing number.

- Customer Service: Call Bank of America’s customer service at 1-800-432-1000.

Routing Numbers by State

Below is a table listing Bank of America’s routing numbers based on the state where you opened your account.

| State | Routing Number |

|---|---|

| Alabama | 051000017 |

| Alaska | 051000017 |

| Arizona | 122101706 |

| Arkansas | 082000073 |

| California | 121000358 |

| Colorado | 123103716 |

| Connecticut | 011900571 |

| Delaware | 031202084 |

| Florida | 063100277 |

| Georgia | 061000052 |

| Hawaii | 051000017 |

| Idaho | 123103716 |

| Illinois | 071000505 |

| Indiana | 071214579 |

| Iowa | 073000176 |

| Kansas | 101100045 |

| Kentucky | 042000013 |

| Louisiana | 051000017 |

| Maine | 011200365 |

| Maryland | 052001633 |

| Massachusetts | 011000138 |

| Michigan | 072000805 |

| Minnesota | 071000505 |

| Mississippi | 051000017 |

| Missouri | 081000032 |

| Montana | 051000017 |

| Nebraska | 051000017 |

| Nevada | 122400724 |

| New Hampshire | 011400495 |

| New Jersey | 021200339 |

| New Mexico | 107000327 |

| New York | 021000322 |

| North Carolina | 053000196 |

| North Dakota | 051000017 |

| Ohio | 071214579 |

| Oklahoma | 103000017 |

| Oregon | 323070380 |

| Pennsylvania | 031202084 |

| Rhode Island | 011500010 |

| South Carolina | 053904483 |

| South Dakota | 051000017 |

| Tennessee | 064000020 |

| Texas | 111000025 |

| Utah | 123103716 |

| Vermont | 011600033 |

| Virginia | 051000017 |

| Washington | 125000024 |

| Washington D.C. | 054001204 |

| West Virginia | 051000017 |

| Wisconsin | 075000019 |

| Wyoming | 051000017 |

Note: The routing number 051000017 is used for multiple states where Bank of America does not have a separate routing number.

It is important to have the correct routing number, especially if you’re dealing with multiple banks that may operate with distinct identifiers for various states.

Different Types of Routing Numbers

Bank of America, like many large banks, uses different routing numbers depending on the type of transaction:

1. ABA Routing Number

- Purpose: Used for paper transfers and checks.

- Example: The routing number you see on your personal checks.

2. ACH Routing Number

- Purpose: Used for electronic transfers and withdrawals.

- When to Use: Setting up direct deposits, automatic payments, or electronic bill payments.

3. Wire Transfer Routing Number

- Routing Number: 026009593

- Purpose: For sending or receiving wire transfers within the U.S.

International Wire Transfers:

- SWIFT Code: BOFAUS3N

- Purpose: Used for international wires in U.S. dollars.

- SWIFT Code for Foreign Currency: BOFAUS6S

How to Use Them

Setting Up Direct Deposit

- Your Account Number: Found on your checks or bank statement.

- Bank of America’s Routing Number: Based on your state or use the ACH routing number.

Making a Wire Transfer

- Use the domestic wire transfer routing number: 026009593.

- Provide the recipient’s name, account number, and address.

International Transfers:

- Use the SWIFT code BOFAUS3N.

- Include the recipient’s international bank details.

Ordering Checks

When ordering new checks, ensure the routing number printed is correct to avoid any transaction issues.

Tips for Ensuring Accurate Transactions

- Double-Check Numbers: Always verify your routing and account numbers before initiating a transaction.

- Contact Customer Service: If unsure, reach out to Bank of America directly.

- Update Stored Information: If you’ve moved or opened a new account, make sure to update your routing number information with employers or service providers.